With the completion of sending the data of the distribution companies to the TITK system of the Food and Drug Administration and the verification of these data by the experts of the organization, the country's drug statistics in 1999 was posted on the website of the Food and Drug Administration on Wednesday, August 11th.

According to the Tasnim News Agency's health correspondent, the country's drug statistics, after a 1.5-year hiatus, were published last Wednesday by the Food and Drug Administration and made available to researchers and activists in the pharmaceutical industry. In this memo, while giving a brief history of how the statistics were formed, the characteristics of the new statistics are explained.

History of drug statistics

The Food and Drug Administration started publishing drug statistics in 2015, and this trend continued until 1997. These statistics provide an overview of the country's pharmaceutical market based on the type of drug, the share of suppliers, and so on. In 1997, the statistics of the first 8 months of the year were published and then the process of publishing the statistics was stopped for 1.5 years. In order to eliminate the shortcomings of previous statistics and also to optimize the process of preparing statistics, the Food and Drug Administration from the end of 1997 received data related to drug distribution companies online through the Titek system to be able to collect accurate and online statistics based on data from distribution companies. Slowly

With the completion of sending the data of the distribution companies to the TITK system of the Food and Drug Administration and the verification of these data by the experts of the organization, the country's drug statistics in 1999 was posted on the website of the Food and Drug Administration on Wednesday, August 11th.

New statistics features

The new statistics for the year 1999 have features that distinguish it from other drug statistics published by the Food and Drug Administration. The first distinguishing feature of the new statistics is that this statistic is based on the data sent by broadcasting companies to the Titek system, and since the data exchange between these companies and the Titek system is done online, the Food and Drug Administration has the country's online statistics and managers Organizations can use it for policy-making and data-driven forecasting.

The second distinguishing feature of the new statistics is that it provides analysts with more information about drugs: product code, whether the product is biological or OTC, under-licensed production, active ingredient, number per package, etc. are among the information added to the new statistics. Has been. This information was not present in any of the previous statistics, so by adding this information to the new statistics, more complex analyzes of the Iranian pharmaceutical market can be provided.

The important point is that if the drug distribution companies provide the correct data to the Food and Drug Administration, in addition to publishing the country's pharmaceutical statistics in a timely manner, other new information can be added to the statistics and provide a more accurate picture of the country's pharmaceutical market.

Overview of the Iranian pharmaceutical market

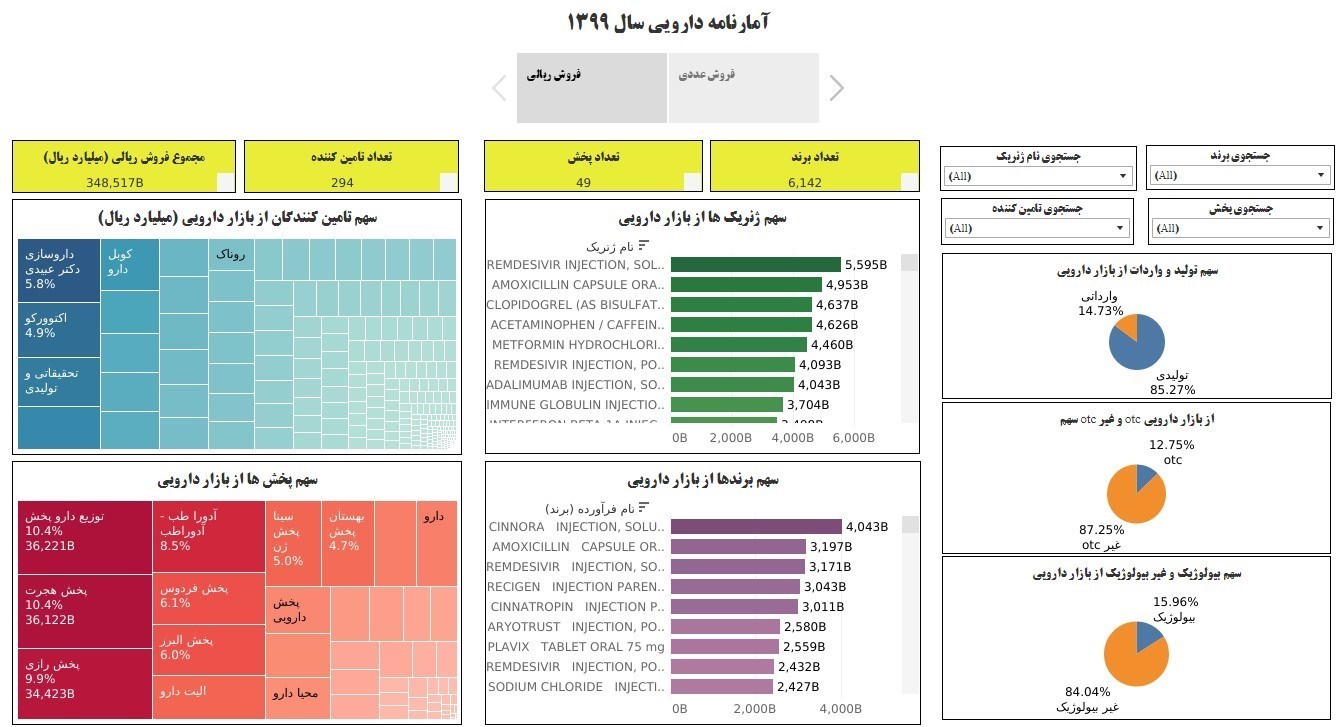

According to the pharmaceutical statistics of 1399, the Iranian pharmaceutical market is a market of 34 thousand billion Tomans. In this market, there are 294 drug suppliers, 49 distribution companies, 6,000 pharmaceutical brands and 1929 pharmaceutical generics.

In terms of Rials, 85% of the Iranian pharmaceutical market is the share of domestic production and 15% is the share of imports. On the other hand, 85% of the rial value of the pharmaceutical market is related to non-biological drugs and 15% is related to biological drugs.

According to the drug statistics of 1999, remedsivir, amoxicillin, clopidogrel and acetaminophen are the four best-selling genres in 1999. Also, Sinora, Amoxicillin, RamedSavier and Recision brands have the largest share of Rial sales in the Iranian pharmaceutical market.

Among drug suppliers, Dr. Obidi Pharmacy with about 6%, ranks first in Rial sales of the Iranian pharmaceutical market. Octovorco is in second and third place with about 5% and Sinagen with about 4.5%.

Among drug distribution companies, Drug Distribution Company, Hijrat Distribution Company and Razi Distribution Company with a share of about 10%, have occupied the first three ranks of Rial sales in the Iranian pharmaceutical market, respectively.

Interactive dashboards of Iranian pharmaceutical statistics

In order to further analyze the data related to drug statistics, for the first time in the country, the interactive dashboard of drug statistics of 99 has been published. Using this dashboard, the country's pharmaceutical market can be examined interactively (statistics link).

In this dashboard, it is possible to search by brand name, generic name, supplier and distributor. This dashboard allows the analysis of Rial sales and numerical sales separately. It is also possible to provide interactive and complex analysis of statistics using the filters feature on the charts. The following figure shows an image of the statistics management dashboard.

Conclusion

Pharmaceutical statistics help researchers to have a general analysis of the Iranian pharmaceutical market and use it for future needs, forecasts and planning. These statistics can be used by policymakers as well as pharmaceutical industry activists to plan the production or import of drugs. In order to publish accurate and online statistics, all stakeholders, including drug suppliers and distributors, must submit their data correctly, accurately and online to the electronic systems of the Food and Drug Administration (TITEC).

Dissemination of governance data by institutions and agencies and its analysis by experts and the media is one of the pillars of good governance. Data analysis is very common in private businesses, but in the public sector, data analysis and data-driven decision-making are still relevant.